January 6, 2026

Timing Is Now the Competitive Advantage in Auto Lending

Auto loan demand remains strong, especially among Prime and near-Prime borrowers. What’s changed isn’t whether people are financing vehicles, but how and when they make those decisions.

Today’s buyers begin their journey online. Long before they walk into a dealership or talk to a lender, they research vehicles, compare monthly payments, and narrow their options. This shift has reshaped the competitive landscape for credit unions, not because of credit quality or rates, but because timing now matters more than ever.

Recent Experian data shows banks have surpassed 30% of total auto loan share, while other lenders, including credit unions, have lost ground (State of the Automotive Finance Market Report: Q3 2025). This isn’t a sign of declining demand. It’s a signal that lenders who engage members earlier in the shopping process are gaining an advantage.

Prime Borrowers Are Still Active. They’re Just Deciding Earlier.

More than 82% of new auto loans continue to come from Prime and Super Prime borrowers (Experian, SAFM Q3 2025). High-quality members are still actively financing vehicles.

The challenge for credit unions isn’t risk — it’s presence. When lenders rely primarily on post-decision lending, they engage members only after a vehicle and dealer have already been chosen. At that point, financing often becomes a rate-only conversation, with limited opportunity to influence the outcome.

By contrast, manufacturer-backed lenders succeed because they are embedded directly into the shopping experience. Incentives, payments, and financing options appear early, before the buyer has made up their mind.

People do their research before they ever walk into a financial institution. If you reach them while they’re searching, they may never default to a competitor at all.

Rising Payments Are Changing How Members Shop

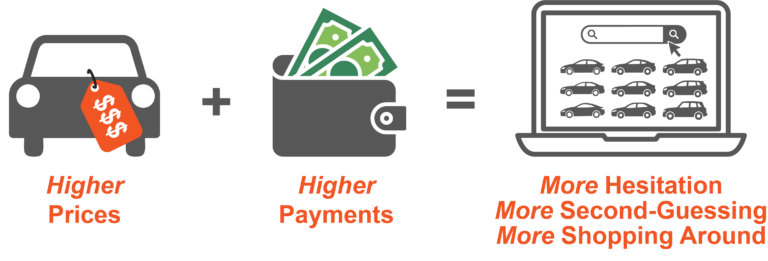

Vehicle prices, loan amounts, and monthly payments continue to rise, with more than 15% of new auto payments now exceeding $1,000 per month (Experian, SAFM Q3 2025). As affordability pressure increases, consumers are becoming more cautious and more payment-focused.

This shift is reflected in the growth of longer loan terms. The rise in 73-month-plus financing shows how many borrowers are stretching terms to make payments work (Experian, SAFM Q3 2025). In this environment, early guidance matters. Members benefit from understanding what vehicles and payment structures fit their budget before they commit.

When payments rise, hesitation rises too.

Buyers start asking:

- “Can I afford this?”

- “Should I stretch my term?”

- “Am I choosing the right vehicle?”

Helping answer those questions earlier leads to better decisions and a smoother financing experience.

How GrooveCar Direct Helps Credit Unions Compete Earlier

GrooveCar Direct is designed to help credit unions engage members during the shopping phase when lender choice is still undecided.

As banks and captives gain share by showing up earlier in the buying journey, GrooveCar Direct brings that same early presence into a credit union–branded experience. Members can explore vehicles, compare payments, and evaluate affordability while staying connected to the financial institution they already trust.

Because many consumers shop by monthly payment rather than vehicle price, GrooveCar Direct supports payment-driven decision-making from the start, reducing last-minute friction and helping members make informed choices with confidence.

The Real Value Isn’t Stealing Shoppers. It’s Preventing Drift.

This isn’t about replacing search engines or disrupting how people shop.

The real value is simpler and more powerful.

When members already trust their credit union, offering car shopping inside that relationship keeps them from defaulting to competitors.

It’s not:

“We intercept shoppers from competitors.”

It’s:

“We give members a reason not to leave in the first place.”

That moment of “Oh wow, my credit union does this?” is where trust turns into action. GrooveCar Direct works because it meets members inside a relationship they already value, at the moment they’re deciding where to go next.

More Than a Shopping Tool

GrooveCar Direct also provides credit unions with real-time insight into member intent. Shopping activity alerts allow loan teams to identify engaged members earlier and follow up at the right moment before decisions are finalized and before competitors step in.

In a market where demand is still strong but competition is intensifying, early engagement isn’t just helpful. It’s essential.

The Bottom Line

GrooveCar Direct helps credit unions reach members while auto buying decisions are still forming, not after financing becomes an afterthought. Earlier engagement leads to smarter decisions and more auto loans retained in-house.

See how credit unions can compete earlier in the auto shopping journey. → Request a GrooveCar Direct Demo